RE: Home Appreciation Rates, What Is Normal?

The same story has been on repeat in The Greater Denver Area since 2012, significant and atypical appreciation has captured many headlines across the United States as we continue to rank in the top 5 for major metropolitan areas for home price growth. Denverites and surrounding communities have seen home prices skyrocket from the just after the recession from 2007-2011 and since 2012 it seems that the sky is the limit. Entering the most frenzied point of our year, typically March-May, it’s important that we begin to set more reasonable expectations for annual appreciation. Danger lies in overpricing as affordability issues begin to surface in Denver, and when interest rates begin to normalize rising above 4.5% expectations for appreciation need to be reset to more historical ideals.

So, what is a good rate of appreciation?

Appreciation is based upon the % change in sales price in a given area year over year. Different areas and styles of homes can appreciate at greatly different rates, which always ties back to the relationship between supply and demand. A common key that we can use to determine what appreciation should be is the based upon the rate of inflation. Inflation can be described as the decline in the purchasing power of your money, or the increase in the price you pay for goods. Over time, money is said to inflate, or lose purchasing power and the cost of goods and services rise. How inflation relates to appreciation is that we want home prices to appreciate faster that the value at which purchasing power declines, so if it is reported that home prices are going up at 1-2% more than the rate of inflation homeowners are naturally making money from their homeownership by doing nothing more than making their monthly payments. The historic rate of inflation in the United States since the beginning of the millennium is around 2%, so if an appreciation rate is reported at 3-4% we are seeing an appropriate amount of home value growth.

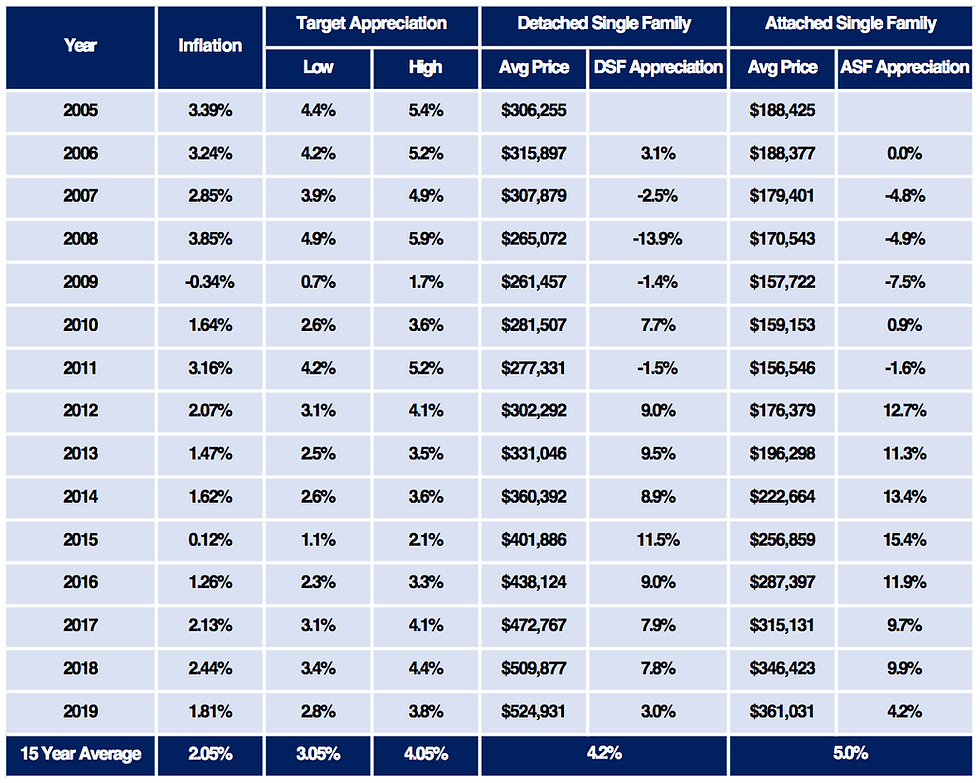

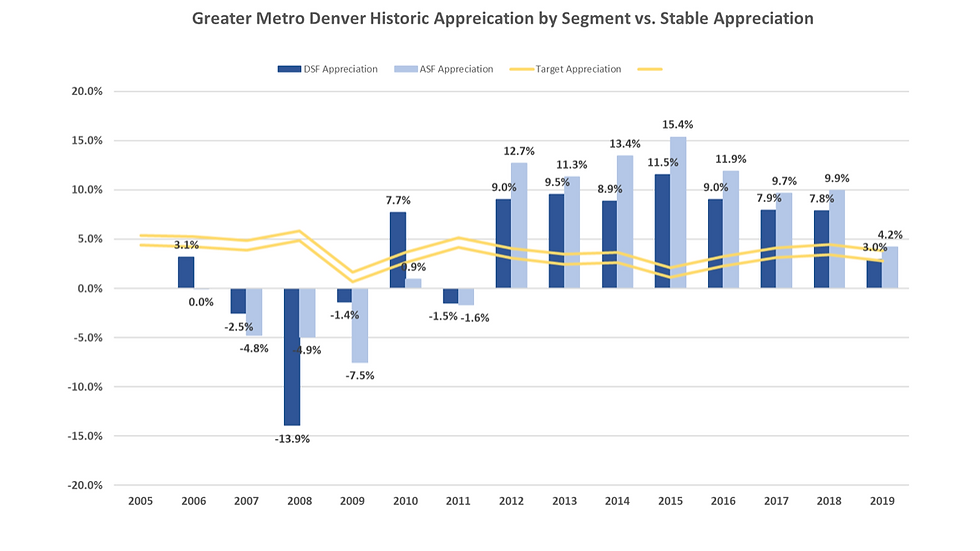

How do Inflation and Appreciation look specifically for Greater Metro Denver?

The years leading into the recession reported inflation rates bouncing between high 2% and high 3%, until 2009 when we slid into the bottom of the recession, at which point we saw negative inflation. When inflation increases, appreciation needs to increase as well for home owners to make passive equity on their real estate. Unfortunately, home prices fell, at their worst in 2008 they fell by nearly 14% for detached single family homes, and -7.5% for attached single family homes in 2009. During the recession, new home construction stalled which in effect was the beginning of the appreciation sling shot from 2012 through 2018. When new construction stalled, and our population growth nearly doubled historic levels the relationship between supply and demand fell below 2 homes available per buyer creating many multiple offer situations, ultimately driving prices in record appreciation rates from 2012 through 2018.

So, what happened in 2019? Why did our appreciation rate fall to 3-4%?

In short, 90% of our annual appreciation is established between January-June each year. Rising interest rates at the end of 2018, carried through June of 2019 tipped affordability scales quickly and dampened the typical run up in average sales price. As interest rates go up, nearly 9 out of 10 buyers in Metro Denver will experience a loss of buying power- 90% of buyers require financing to purchase a property. Coupling the higher interest rates with the significant snow levels we saw in the beginning of 2019 slowed appreciation rates. Near the end of 2019, Denver saw 5-6% year-over-year growth in average sales price but the quantity of transactions lacked the totals needed to make up for the first half of the year. Even though appreciation was down, Denver landed in the the target zone of 2.8-3.8% appreciation with 3.0% appreciation for DSF and 4.2% for ASF. We need the conditions to be favorable for growth from January-June, low inventory, low rates, good weather. If these conditions don’t exist higher than average appreciation is not possible.

What do we hope to see in 2020?

Heading into 2020 historic low levels of inventory were reported at the very beginning of the year, interest rates remained below 4.0% on 30-year fixed loans, the Broncos were out of the running for the Super Bowl and so far weather has remained mild. All 4 of these factors lend their hand to enhanced appreciation, and the first 6 months of the year are critical. If weather holds, inventory remains low along with lower interest rates we are likely to beat the rate of inflation yet again in 2020.

Sourcing information:

Megan Aller, First American Title Insurance Company

720-229-6641, Maller@FirstAm.com

Title insurance license: 360158

Real estate license: FA100080623, SkyLightPark LLC

REALTOR NRDS: 219534435

Included in this presentation include data from the following sources:

This representation is based in whole or in part on content supplied by REcolorado®, Inc. REcolorado®, Inc. does not guarantee nor is it in any way responsible for its accuracy. Content maintained by REcolorado®, Inc. may not reflect all real estate activity in the market. Dates shown on graphs for timeframes included.

The views expressed here reflect only my personal views and are not necessarily the views of my employer.

Kommentare